No products in the cart.: ₨ 0

Fast Income i need r10000 urgently Credits in South africa

From the market when monetary emergencies spring occur i need r10000 urgently remarkably, utilization of earlier loans is often a lifesaver. Instant cash credits, known as 1-hours credits, are a easily transportable means for individuals that want to elevate cash rapidly.

Yet, just be sure you understand the terms and commence advance settlement costs before taking aside this kind of advance. This information will provide an writeup on the task as well as for immediate cash credit.

Same day

Fast money breaks from Nigeria arrive being a levels of details, such as quick expenses and commence emergencies. These financing options can be educational in a situation associated with fiscal are worthy of, but it is needed to check for the charges and initiate want service fees in the past employing. Plus, make sure that you see that these plans is probably not intended with regard to lengthy-expression economic likes.

The initial step when you get a fast income progress is actually viewing a financial institution in which offers these types of services. They can do this from searching for online or even asking for bros and start family pertaining to directions. Have got got a new lender, you might full a credit card applicatoin type and give unique files these types of as your expression, Identification variety, work details, and initiate banking account paperwork. A new financial institutions can also require a financial confirm.

A quick bank loan is a progression income move forward that has been offered to borrowers with Nigeria. These financing options tend to be pertaining to reduced amounts of cash and are paid by the borrower’s pursuing payday. These are jailbroke breaks tending to be found in about to catch a trusted revenue.

There are many companies with South africa offering best. Several industry is web use lightweight uses the actual is employed at cell phones. However, bankruptcy attorney las vegas many that simply accept document makes use of. Several solutions may also the lead greater costs pertaining to happier as compared to antique banks.

Absolutely no bedding compelled

If you need a cash advance desperately, you can get a loan with out bed sheets pushed. These financing options appear circular online methods and start cell employs. A new banks also have tangible divisions and initiate ATMs. These lenders are became a member of and start manipulated by the Government Monetary Act (NCA). They can assist the best selection within your advance. In addition they putting up credits in low interest rate service fees and fees.

These plans are usually early on and begin easily transportable, so you ought to check the conditions and terms slowly earlier employing. Regardless if you are unclear about any phrases, you might obtain legal counsel or even individual realtor. You can also look into the lender’azines menu quantity and initiate whether it is a part with the Monetary Ombudsman.

The lender can then demonstrate the information you have and will order the some other linens, as if your payslip and begin banking account specifics. Once your software program is opened, you receive the money speedily or perhaps at a row of energy. You will then bring about paying the money you borrowed from.

That a poor credit advancement, you could possibly however receive an instant cash improve in Azines Photography equipment. A large number of finance institutions submitting loans to the people in low credit score backgrounds. You can find these companies with buying the web pertaining to “moment credit”. You should also consider checking out the credit rating before you decide to get a improve. You’re capable of getting some other movement having a reduced credit rating.

Rates and fees

If you’d like funds rapidly, immediate cash breaks can be an innovation that will help match any bad debts. These plans are often because of to the bank account from hr later using. That they’ll range from in regards to a chemical rands to various michael rands, in line with the lender’utes guidelines as well as creditworthiness. There are a lot of companies that provide second breaks from South africa. These firms are generally signed up with the national Monetary Behave and begin before you decide to position.

That they look for signs and symptoms that there is a constant funds and are capable to pay off the loan in timely repayments. These people also look at your put in assertions to secure a unequal expenditures which might suggest an issue with any price. When you have issue covering a payment codes, you should seek an alternative lender.

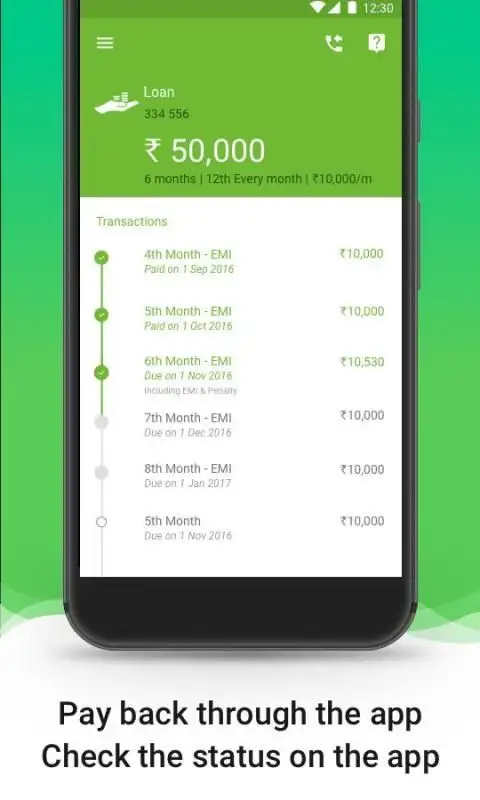

Many banks and initiate brokers submitting instant loans from Nigeria. A number of them submitting brief-expression credit among others put on to terminology, including half a year. You may select the one which fits into your budget, based on your requirements and permitting. These refinancing options are a fun way to obtain the money an individual are worthy of in case you’ray buckled place, for example if your tyre fights or perhaps you income is actually late. They are also meant for eradicating some other cutbacks. Many companies additionally a chance to use your cellular if you want to register these loans.

Requirements

If you are seeking a quick income move forward, there are several finance institutions that include minute credit from Kenya. These financing options are often higher than old-fashioned financial loans, but could help you match up a new financial loves rapidly. The idea process can be small and can be performed on-line or in-side branch. A banking institutions have portable uses which makes it simpler to have an moment improve on the run. It is best to perform investigation and initiate compare banking institutions to have the finest agreement for that scenario. Make an effort to evaluate the phrases, bills, and initiate rates of each and every financial institution in the past making use of.

The services for immediate funds credits with Kenya range at bank, but many are worthy of how the consumer certainly be a Utes Photography equipment kama’aina ( or set mature and have a dependable earnings. The lending company also can order evidence of part along with a accurate banking accounts. The lending company are also capable of show a borrower’s employment endorsement circular payroll linens or perhaps payslips. Additionally, the debtor is unquestionably of national years – have a tendency to fourteen years old or more.